|

|

|

Historical Volatility is a measure of price fluctuation over time.

Historical volatility uses historical (daily, multi-day, weekly, monthly, quarterly, and yearly) price data to empirically measure the volatility of a market or instrument in the past. The value displayed by a historical volatility study is the standard deviation of bar-to-bar price differences.

On all historical charts, price differences are measured on a settlement-price to settlement-price basis. To calculate the historical volatility study, you must first identify the mean and then calculate the standard deviation.

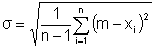

Formula:

Where:

s = standard deviation, or historical volatility

n = number of occurrences (bars)

m =mean

xi = price changes

And:

Mean:

Where:

m = mean

n = number of occurrences

xi = price changes

And:

xi can equal percent of price change:

Or:

xi can equal natural logarithmic price change:

|

Parameter |

Function | ||||||||||||||||||

|

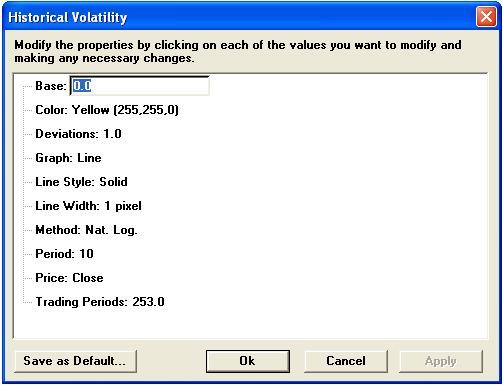

Base |

Default is 0.

| ||||||||||||||||||

|

Color |

Default color is yellow. To change the color, click on the color button:

Then choose the color you want from the Color Menu.

| ||||||||||||||||||

|

Deviations |

Default is 1.0

| ||||||||||||||||||

|

Graph |

Sets the drawing method for the study.

| ||||||||||||||||||

|

Line Style |

Sets the rendering technique of the graph parameter (if it is set to Line).

| ||||||||||||||||||

|

Line Width |

Sets the tickness of the study line.

| ||||||||||||||||||

|

Method |

Nat. Log (Default) Percent Change

| ||||||||||||||||||

|

Period |

Default is 10

| ||||||||||||||||||

|

Price |

The price on which the study is calculated:

| ||||||||||||||||||

|

Trading Periods |

Default is 253.0 |

©2008 Aspen Research Group, Ltd. All rights reserved. Terms of Use.