|

|

Technically a stochastic, Williams %R signals overbought and oversold conditions by calculating the relationship of the close to a range of prices. The scale in Williams %R is reversed, running from -100 to 0. When the %R line is above -20, overbought conditions exist; conversely, when the %R line is below -80, oversold conditions exist.

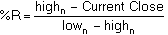

Formula:

Where:

n = number of periods

highn = highest high in n periods

lown = lowest low in n periods

|

Parameter |

Function | ||||||||||||||

|

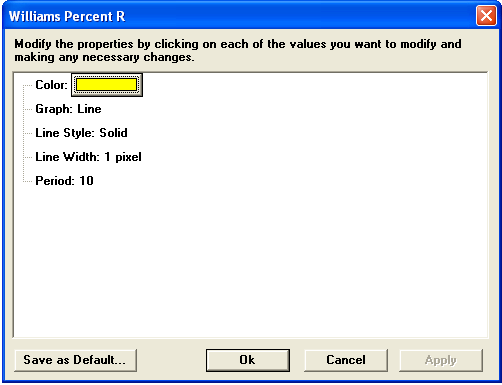

Color |

Default color is yellow. To change the color, click on the color button:

Then choose the color you want from the Color Menu.

| ||||||||||||||

|

Graph |

Sets the drawing method for the study.

| ||||||||||||||

|

Line Style |

Sets the rendering technique of the graph parameter (if it is set to Line).

| ||||||||||||||

|

Line Width |

Sets the tickness of the study line.

| ||||||||||||||

|

Period |

|

see, Larry R. Williams, How I Made $1,000,000 Trading Commodities Last Year, 3rd Ed., Monterey CA: Conceptual Management, 1979; see also, Murphy, John J., Technical Analysis of the Futures Markets, A Comprehensive Guide to Trading Methods and Applications, New York: New York Institute of Finance, A Prentice-Hall Company, 1986, pp. 309-310.